At Schlun & Elseven Rechtsanwälte, our corporate law specialists are here to answer all your questions about company registration and formation in Germany. Our lawyers will advise you on the form your German company should take while alerting you to the risks and benefits involved in the different types of business models. Once we establish a working relationship, our experienced corporate lawyers will handle all issues your company may have.

By allowing our lawyers to take care of the paperwork requirements, your company can focus on the other aspects of moving into the lucrative German market. Please, do not hesitate to contact us directly for specialised legal assistance and support.

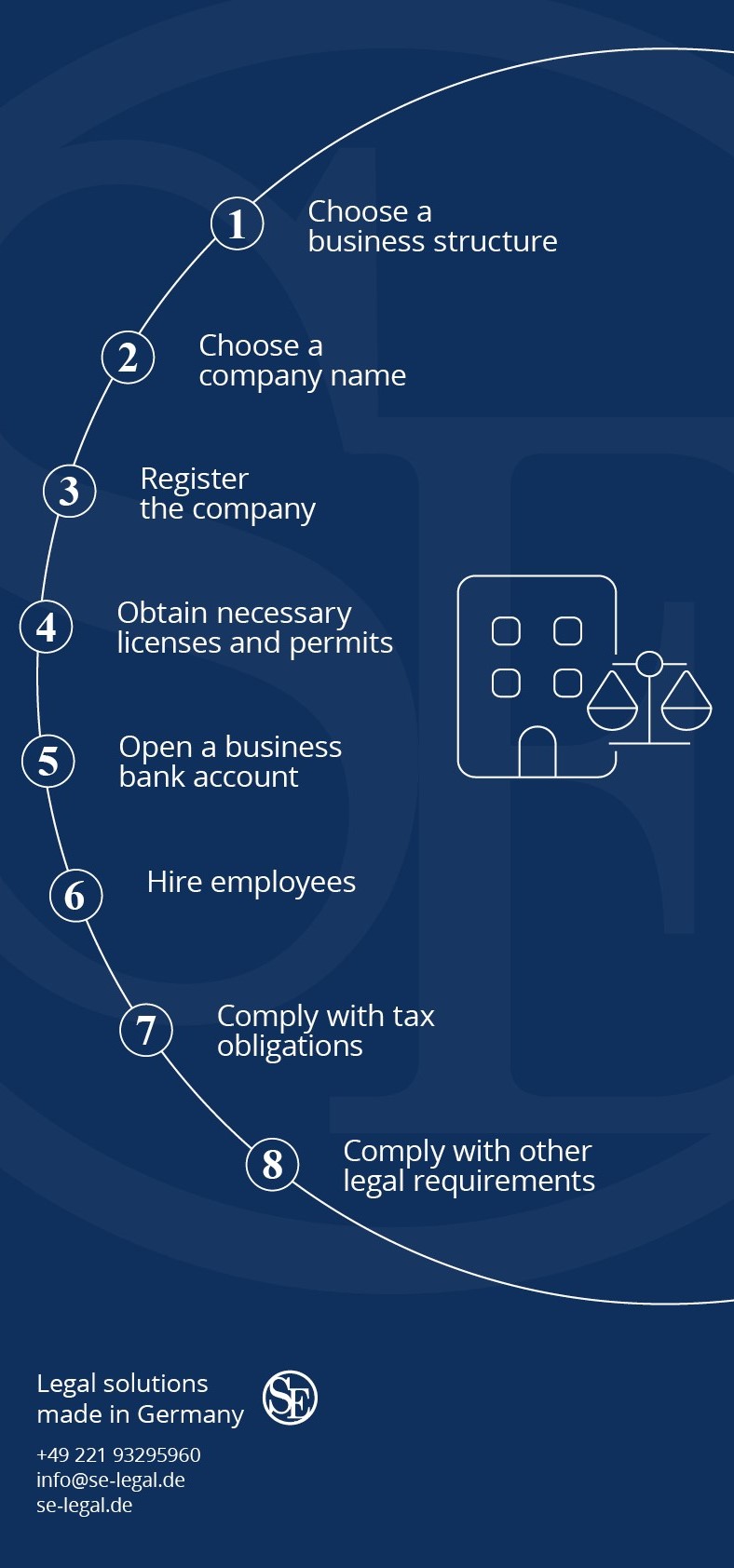

Necessary Steps for Company Registration and Formation in Germany

Here are some of the critical steps to be considered in the company registration process.

Business Plan: A detailed business plan should be designed when establishing a company. This business plan will be used when seeking investment, tracking progress and evaluating solutions to potential difficulties in the future. A good business plan will outline an enterprise’s unique aspects and where the gap in the market is for this business idea. It will provide investors, potential partners and employees clarity regarding the company’s aims, direction, and opportunities that the company is seeking to exploit. Our team of legal professionals are available to oversee your company’s business plan.

Company form: A well-designed business plan will also determine which type of company should be set up to achieve the goals as outlined in the plan. As a client of our firm, we will provide you with the necessary advice so that the type of company established will be suitable for its goals.

Finances: Once the type of company has been decided on, the next step is to ensure that the necessary financing is available to the company sought to establish.

Name of the Company: If the plan, type of company and finances are all available, the next step is the company’s name. Creating a unique and memorable name is not easy, but it is vital. It is worth knowing that the German Commercial Code (in German “Handelsgesetzbuch” or HGB) regulates how names can be used, and it includes provisions such as the non-allowance for misleading names (§ 18 HGB) and the need for a name to be distinguishable from other companies (§ 30 HGB).

Partnerships: General Partnerships & Limited Partnerships

Partnerships are a means by which entrepreneurs can pool their resources and work together to establish themselves in the market. There are several different forms of partnerships in German law, and they differ significantly in terms of liability, purpose and how they are established.

At Schlun & Elseven Rechtsanwälte, we provide support with registering all forms of partnerships and ongoing support once they are established. Our corporate lawyers advise partners concerning their rights and responsibilities, assist with changing the business model, company registration and expansion into new markets, and ensure that the business is aware of its compliance requirements, among other services.

Partnership models in Germany include the Kommanditgesellschaft (KG), Limited Liability Partnership. Under this model, partners can be either limited partners with limited liability (Kommanditist) or general partners with unlimited liability (Komplementär). The general partners (Komplementär) have a more active role in the company’s management and generally make the daily decisions about the partnership’s direction. In contrast, the Kommanditist acts primarily as an investor in the company. However, this model has also given rise to the GmbH & Co. KG business model, which has also proven prevalent in German business.

Other partnership models in Germany include the Civil Law Partnership (Gesellschaft bürgerlichen Rechts – “GbR”) and General Commercial Partnership (offene Handelsgesellschaft – OHG).

Formation of a Civil Law Partnership (GbR)

The partnership under civil law (GbR) belongs – just like the general partnership (OHG), the sole trader/registered merchant (e.K.) and the general partner in a limited partnership (KG) – to the forms of partnership with unlimited liability. Unlike the general partnership (OHG), however, the purpose of a GbR is not limited to the operation of a commercial enterprise. It also includes charitable, artistic and other non-commercial purposes. Consequently, the GbR is not subject to the provisions of the German Commercial Code (HGB) but to those of the German Civil Code (BGB, §§ 705 – 740). The GbR is particularly suitable for start-ups, freelancers or other associations of persons who want to work together and strive for a joint project that is not exclusively about financial gain.

When establishing such a partnership, the following aspects should be considered:

- Capital requirements: There are no formal requirements regarding a specific financial amount to form the partnership. However, if financial resources are required to achieve the particular purpose of the partnership, it should be ensured at the outset that these resources can be provided.

- Articles of association: The memorandum of association can be concluded orally. However, the contents of this contract and the agreements are difficult to enforce without written proof. A written partnership agreement sets out the objectives of the merger, the responsibilities of the individual partners and the rules relating to voting procedures, distribution of shares and management of the profits/losses generated. It is recommended to seek legal advice in formulating and drafting such a comprehensive contract to make it clear and binding.

- Registration: Unlike the OHG, the GbR does not have to be registered in the commercial register. However, it may have to be registered with the tax office.

Setting up a Business as a Sole Proprietorship / Registered Trader (e. K.)

In the case of a sole proprietorship, one person usually does business under their name. Therefore, there is no legal distinction between the business and the person who runs it. This form of enterprise is the easiest to set up. The founder also has the most control over the company. However, the distinction between sole traders and freelancers must be considered. The sole proprietorship is associated with certain advantages and disadvantages and is generally only suitable for small enterprises.

If you are considering setting up a business in Germany, Schlun & Elseven is your legal partner in German corporate law. We will support you in all legal steps with the necessary expertise and commitment. Our corporate lawyers will highlight the advantages and risks of the various business models and corporate forms. Based on your business idea, they will recommend which legal structure is preferable for your company. Feel free to use the online form below to contact us.

Drafting the Articles of Association

At Schlun & Elseven Rechtsanwälte, we offer a comprehensive range of legal services specifically tailored to assist businesses in drafting their articles of association. Our experienced corporate lawyers are well-versed in German corporate law and provide expert guidance to ensure that the articles accurately reflect the company’s structure, objectives, and compliance requirements.

Our team of skilled attorneys understands the complexities of German corporate regulations and diligently navigates through the legal landscape to ensure that your articles of association meet all statutory requirements. We offer in-depth consultations, thoroughly explaining the legal implications of each provision and assisting you in making well-informed decisions.

Collaborating closely with your company’s founders, shareholders, and management, we take the time to understand your unique business objectives. Our corporate lawyers employ their expertise to craft customised provisions within the articles of association that align with your strategic vision. We believe in clear and precise language, ensuring that the document accurately captures the shareholders’ rights and obligations, the company’s governance structure, decision-making processes, and capital structure.

With our finger on the pulse of the legal landscape and a deep understanding of industry best practices, we can provide valuable insights into emerging trends and regulatory changes. By leveraging our expertise, we help you anticipate potential challenges and leverage growth opportunities through carefully crafted provisions in the articles of association.

Drafting the Company Bylaws

Navigating the intricacies of German corporate regulations can be challenging, but with our expertise, you can trust that your company’s bylaws will comply with all statutory requirements. We offer meticulous consultations, where our experienced attorneys carefully explain the legal implications of each provision and guide you in making well-informed decisions. We aim to ensure that your company’s bylaws accurately reflect its internal structure, governance principles, and operational framework.

By working closely with your company’s stakeholders, management, and founders, we gain a deep understanding of your business objectives. Our corporate lawyers use their expertise to craft customised provisions within the company bylaws that align with your strategic vision. We prioritise clarity and precision, ensuring that the bylaws effectively outline the rights and responsibilities of shareholders, define the board of directors’ composition, establish decision-making processes, and cover other critical governance aspects.

To stay at the forefront of legal developments, our team remains up to date with emerging trends and industry best practices. Drawing on this knowledge, we provide valuable insights to help you anticipate potential challenges and capitalise on growth opportunities by incorporating carefully tailored provisions into your company bylaws.

Entry in the Corporate and Transparency Registers

Our lawyers provide full support and assistance to our corporate clients with their entry into the commercial and transparency registers. We can guide your company through the registration process and the legal requirements surrounding commercial and transparency registers in Germany. Our aim is to ensure our clients comply with relevant regulations and ensure they seamlessly complete all necessary documentation.

With a meticulous approach and attention to detail, we assist our corporate clients in accurately and efficiently completing their entries, enabling them to establish a solid legal foundation and ensuring transparency in their business operations.

Corporate Tax Support

A corporate tax lawyer can be invaluable to businesses of all sizes.

Businesses face many taxes and laws relating to them, such as turnover, trade, corporation, income, and capital gains. Often, the importance of a particular tax will depend on a myriad of factors, including the type of business you are running and whether your business can seek exemptions in certain areas.

At Schlun & Elseven Rechtsanwälte, our team of corporate tax lawyers can be relied upon in particular cases and in providing ongoing support. Allow our lawyers to assess your company’s tax situation, defend your enterprise in tax dispute matters and provide guidance regarding your rights during tax investigations.

Start-Up Companies in Germany: Comprehensive Legal Guidance

Germany is widely considered one of Europe’s primary hubs for start-up companies. Its popularity as a location for start-ups can be traced to available access to venture capital funds and low levels of market dominance from monopolies and large corporations. Berlin, Frankfurt, Munich and other German cities have proved popular for such companies.

However, start-up companies and business founders face financial, organisational, strategic and legal challenges. The sheer multitude of tasks at hand may intimidate and overwhelm some entrepreneurs.

At Schlun und Elseven Rechtsanwälte, our law firm provides comprehensive legal support and will advise your company in financing, strategy and German law. Our lawyers will accompany you from the preliminary, start-up, development, and growth to the maturing phase and a possible sale of your company. Allow our team to guide you through the company registration process, and get your company started on a solid footing.

As a full-service law firm, we advise corporate clients in legal areas, including German employment and labour law, intellectual property regulation, competition and antitrust law, and designing and enforcing contracts.

Our lawyers will support you in negotiations with investors, customers, employees, suppliers and distributors. We will tailor our legal services to your start-up company’s specific needs and goals through long-term, close cooperation with you as the founder.

Business Immigration to Germany

At Schlun & Elseven Rechtsanwälte, our business immigration team specialises in assisting third-country investors and entrepreneurs to establish themselves in Germany. § 21 German Residence Act. allows entrepreneurs to gain a visa for self-employment in Germany.

However, the business concept must be carefully examined and adapted to the law’s requirements before applying for a residence permit. The three requirements stated for the visa are the following:

- It must meet an economic interest or regional need,

- It shall have a positive impact on the economy,

- The financing must be secured by equity capital or a loan commitment.

The competent authority assesses whether these conditions are met based on a variety of criteria, such as:

- The viability of the underlying business plan,

- The relevant business experience of the applicant,

- The amount of money to be invested in Germany,

- The businesses’ impact on the employment and training situation,

- The project’s contribution to innovation and research.

At Schlun & Elseven Rechtsanwälte, our lawyers will support you throughout the process, and with the subsequent company registration.

Practice Group: German Corporate Law

Practice Group:

German Corporate Law

Contact our Lawyers for German Corporate Law

Please use our online form to outline your request to us. After receiving your request, we will make a brief initial assessment based on the facts described and provide you with a cost offer. You can then decide whether you would like to engage our services.